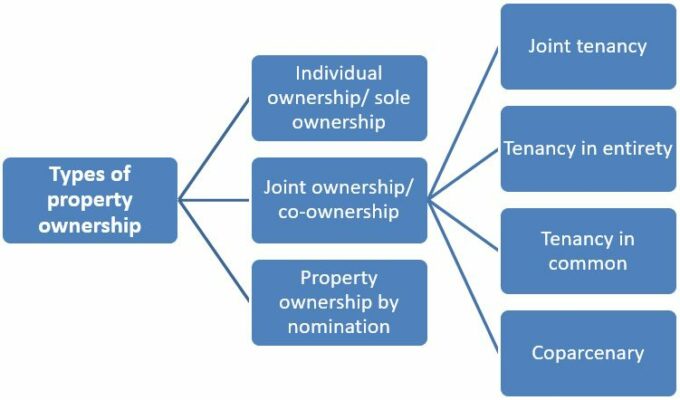

We look at the three types of property ownership and how each impacts the rights and duties of the owners/joint owners

Property ownership can be of several types, depending on the nature of the legal hold that an owner has over an immovable asset. In some cases, it may be absolute ownership while it may not be so in some cases. In fact, there are three types of property ownership, depending on the number of people who own a particular immovable asset. We examine how each category of ownership impacts the rights and duties of the owners/joint owners.

Individual ownership/ sole ownership of property

When a property is bought and registered in the name of one individual, s/he alone holds the ownership title of the property. This type of ownership is known as sole ownership or individual ownership of property. It is pertinent to note that even if other parties have helped the owner to arrange funds for the property purchase, they do not have any right in the property if the sale deed is registered only in the name of the principal buyer. The same is explained below with an example.

Suppose a buyer has taken help from his wife while arranging for the down payment for a home purchase. Suppose that he also makes his wife a co-applicant in the home loan application. However, the property is ultimately registered in the name of the husband. In such a scenario, the property would be held individually by the husband. While it is correct that the wife will have a legal right over the property, because of the prevalent inheritance laws in the country, it will not have any impact on the fact that the property is owned solely by the husband.

Benefits of sole property title holding

Individual ownership is beneficial for the titleholder in many ways. They hold the sole right to decide if and when they want to sell the property, legally speaking.

In the example we spoke of earlier, if the husband were to sell his house, he is not legally bound to take his wife on board. He can single-handedly decide what to do with his property. While the wife can claim her share in the sale proceeds, whether or not she gives her consent for the sale is immaterial as far as the legal formalities are concerned.

No permission from any other party would be required for the same. The division of such a property is also easier, because of the limited number of owners. When the owner dies, his property would be transferred under the provisions made in his will. If there is no will (this is known as the owner dying intestate in legal parlance), specific inheritance laws would apply and the property would be transferred accordingly among the legal heirs of the late owner.

Joint ownership/ co-ownership of property

When a property is registered in the name of more than one individual, the immovable asset is deemed to be under joint ownership. Those holding the title to the property in such ownership, are known as joint owners or co-owners of the immovable asset. It is pertinent to note that there is no difference between joint ownership and co-ownership of property under any law and the two terms can be treated as synonymous. There are several ways to own a property jointly. These include:

Joint tenancy: When the title deed of the property works on the concept of unity and provides each joint owner an equal share in the property, the ownership is known as joint tenancy.

Tenancy in entirety: This form of joint ownership is nothing but joint tenancy between married people. In this system, married couples jointly hold the title of their property. In case any of the two wants to make any changes with respect to their share, they would have to obtain the consent of the other. In this case, the surviving partner will have complete ownership of the property in case of the demise of one partner.

Tenancy in common: When two or more people jointly hold a property without holding equal rights, the joint ownership would be known as a tenancy in common.

Coparcenary: As the Hindu law does not provide for different types of joint ownership, the Hindu Succession Act, 1956, establishes the coparcenary form of ownership among members of Hindu Undivided Families (HUFs). In a coparcenary property, every coparcener acquires an interest by birth. This concept, which is somewhat similar to joint tenancy, allows an unborn child to have an equal share in a HUF property.

If a property is jointly held, each owner will have a say in the manner in which the property is disposed of or distributed in the future. Consequently, its sale and distribution would become a complicated process, if differences of opinions arise among the joint owners.

Property ownership by nomination

Nomination is a process under which a property owner can give someone the right over his immovable property and other assets, in the event of his death. Property nomination has also become a common practice among owners because, by way of this, the landlord can ensure that the property does not remain unclaimed or become subject to litigation after his demise.

This form of property ownership is often seen in cooperative housing societies, which make it mandatory for members to nominate a person at the time of getting a membership. In the event of the death of the owner, the property title is then transferred by the cooperative housing society to the nominee.

However, a nominee does not become the legal owner of the said property, because it has been transferred in his name and he has the possession. According to a Supreme Court verdict of 1983, a nominee is a ’trustee of the property and is liable to hand it over to the late owner’s legal heirs.

According to a Bombay High Court ruling in 2009, this nominee would only represent the legal heirs of the late owner in the form of a trustee and have no ownership rights over the property.

This means a nominee would have no say in the sale and distribution of the property. Buyers of property must, hence, ensure that the seller is not a nominee but an actual owner, before entering into transactions in order to avoid any legal complications in the future.

Source-https://housing.com/news/types-of-property-ownership/

Leave A Reply